Als eine der führenden Europäischen Textilmessen zeigt die MUNICH FABRIC START zweimal jährlich ein qualitatives Portfolio internationaler Stoff- und Zutatenhersteller, die ihre neuesten Entwicklungen und Innovationen in München präsentieren.

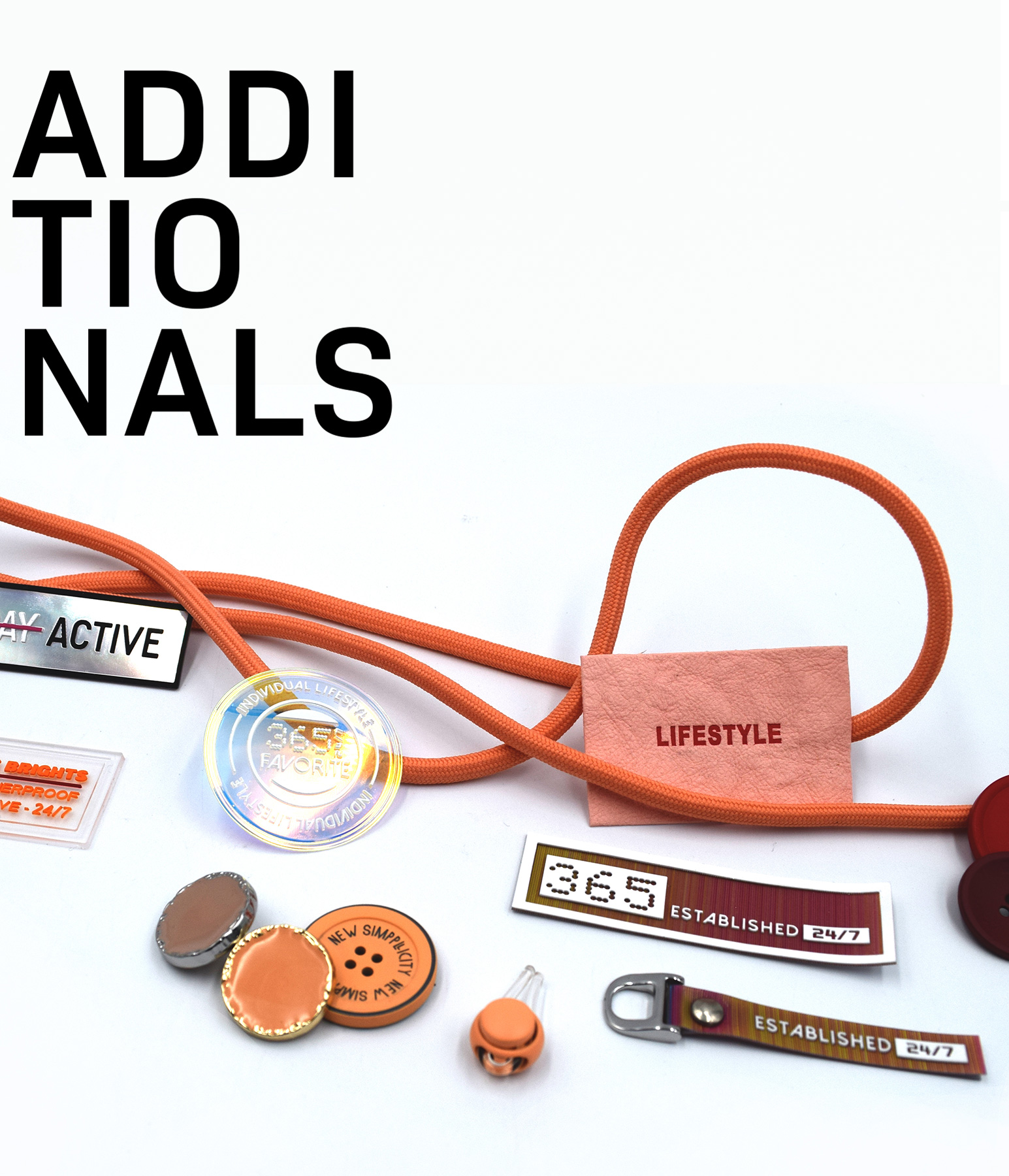

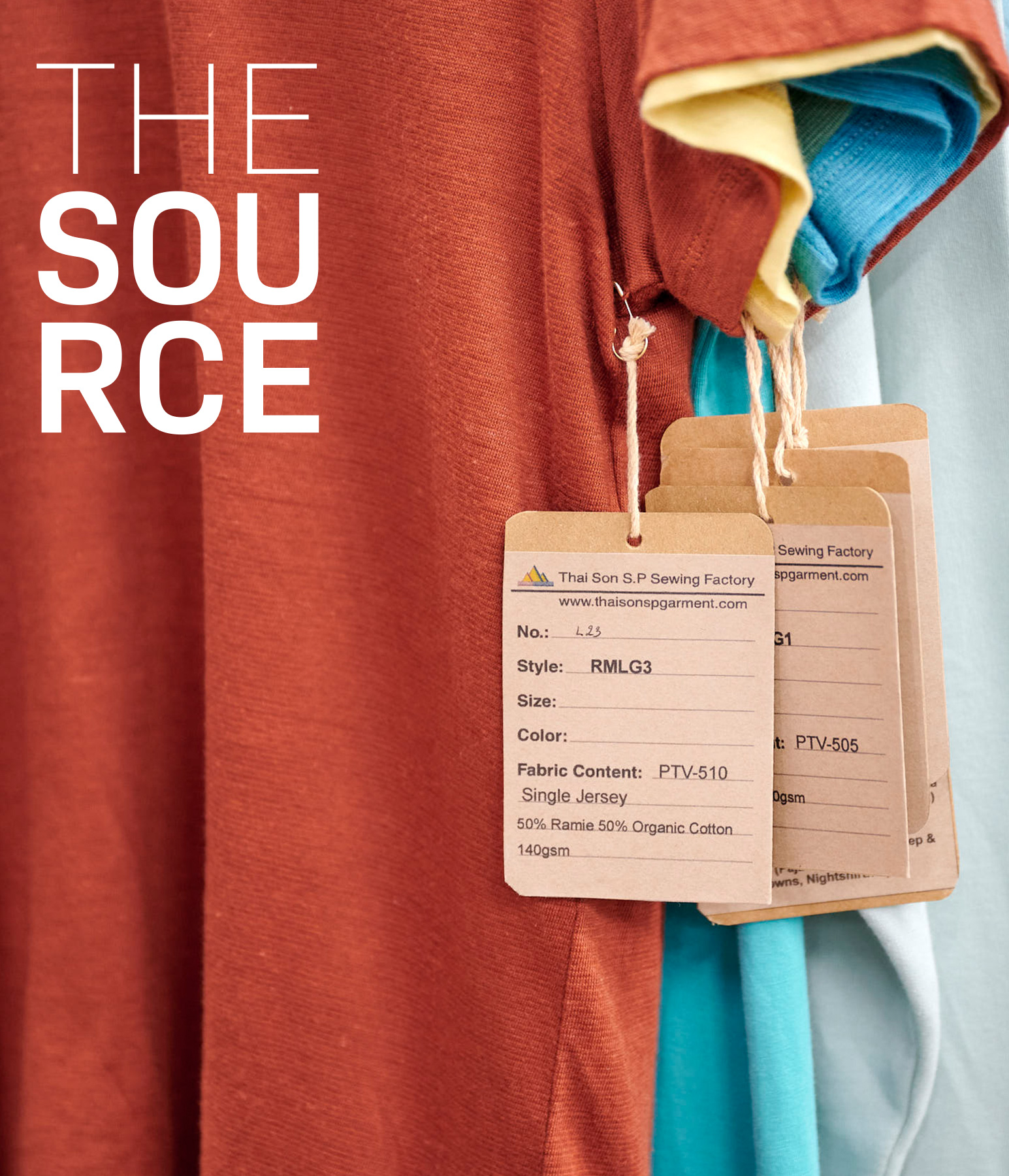

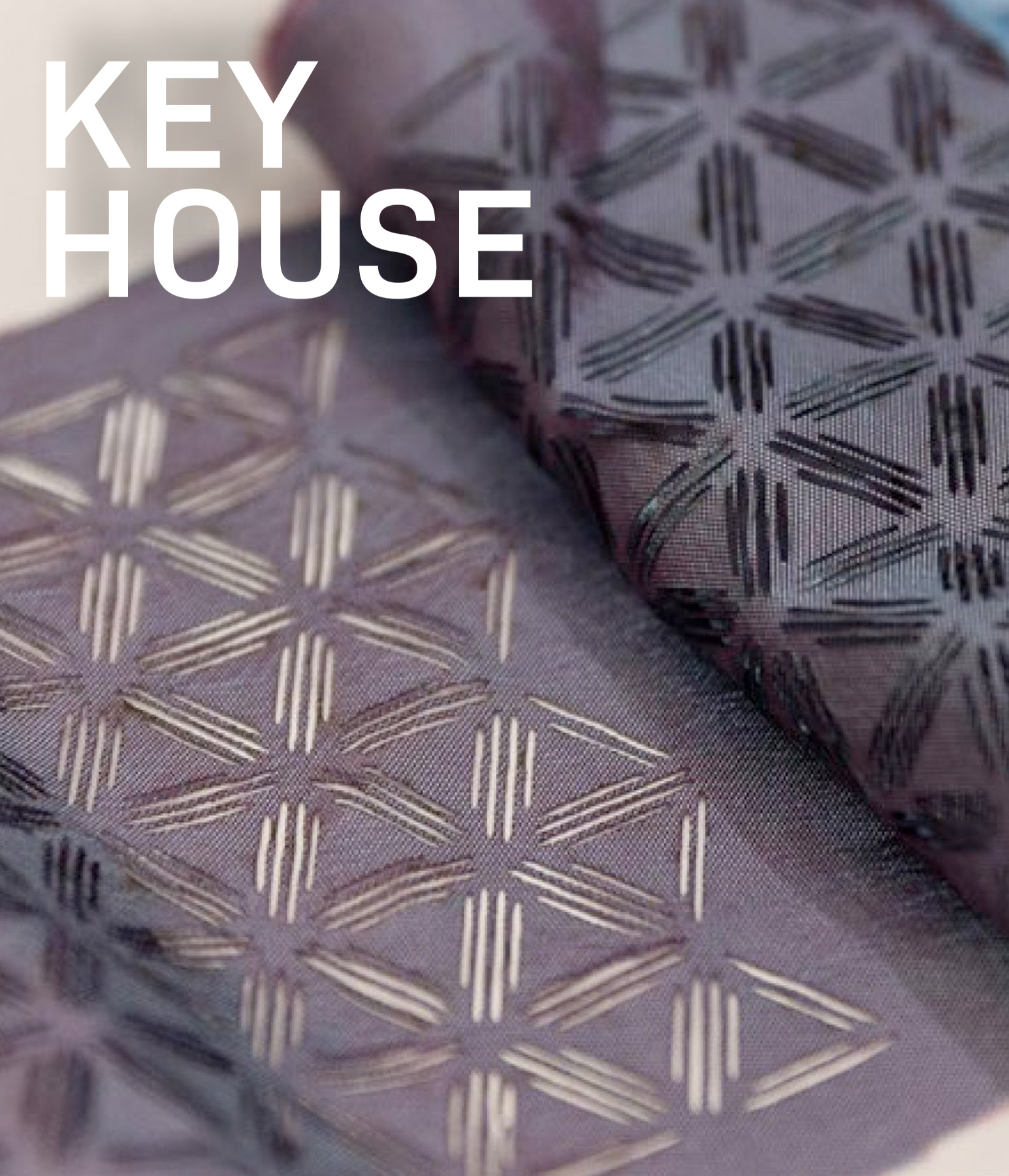

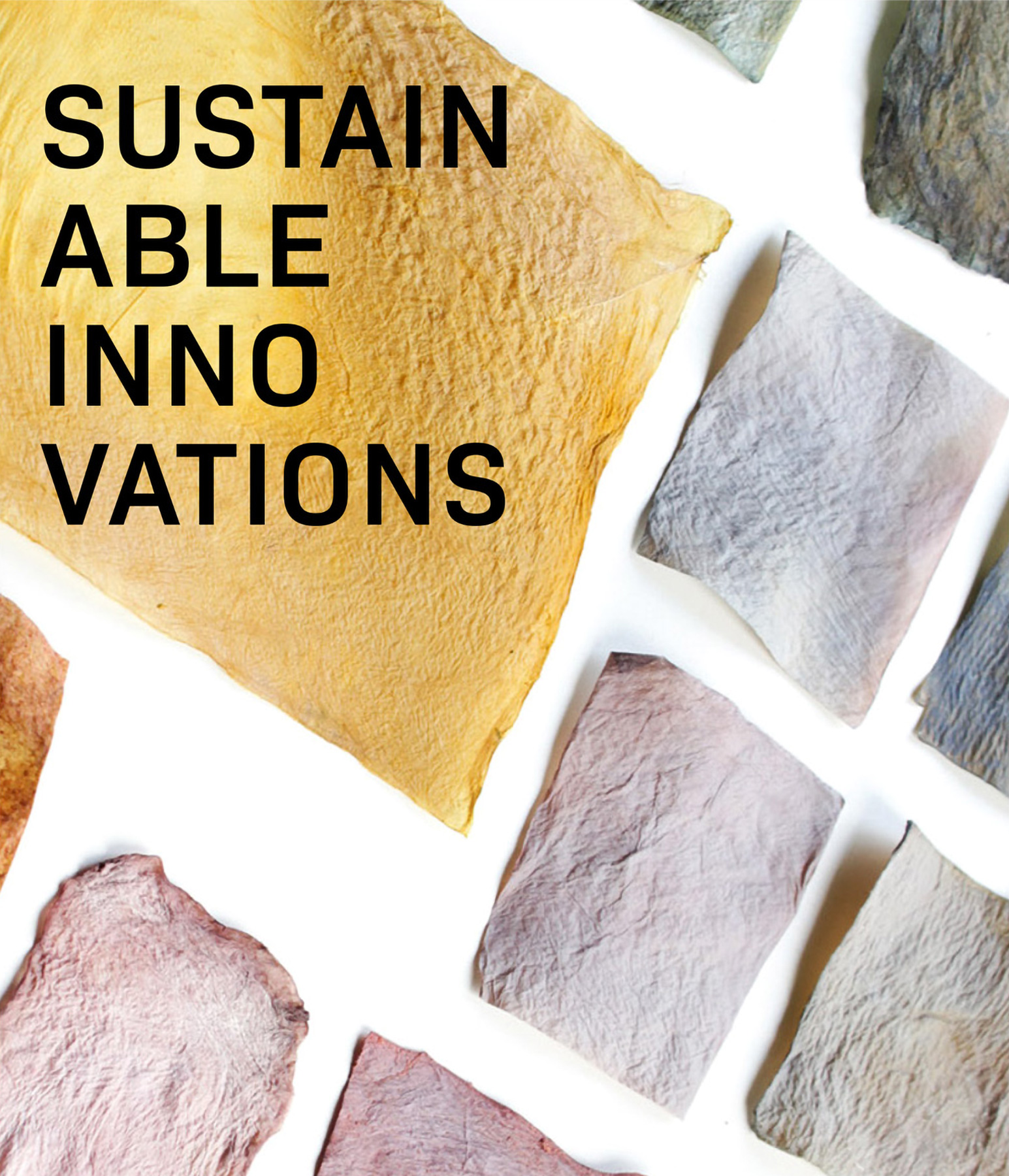

Am 3. & 4. September 2024 wird mit bis zu 1.100 internationalen Kollektionen ein umfassendes Angebot an Textilien, Zutaten, textiler Ausrüstung und Sourcing für die Autumn.Winter 25/26 Saison in München präsentiert.

Diese kompetente Bandbreite an Inspiration und Fachinformationen macht die MUNICH FABRIC START zu einer internationalen Business Plattform in einzigartigem Messeformat, welches jede Saison bis zu 15.000 internationale Fachbesucher nach München zieht.

Die MUNICH FABRIC START Exhibitions GmbH organisiert jede Saison außerdem die Preview Textile Show VIEW Premium Selection sowie die Internationale Denim Trade Show BLUEZONE.